Brookfield’s Nuclear Pivot

Why Wall Street is mispricing Brookfield's nuclear ambitions

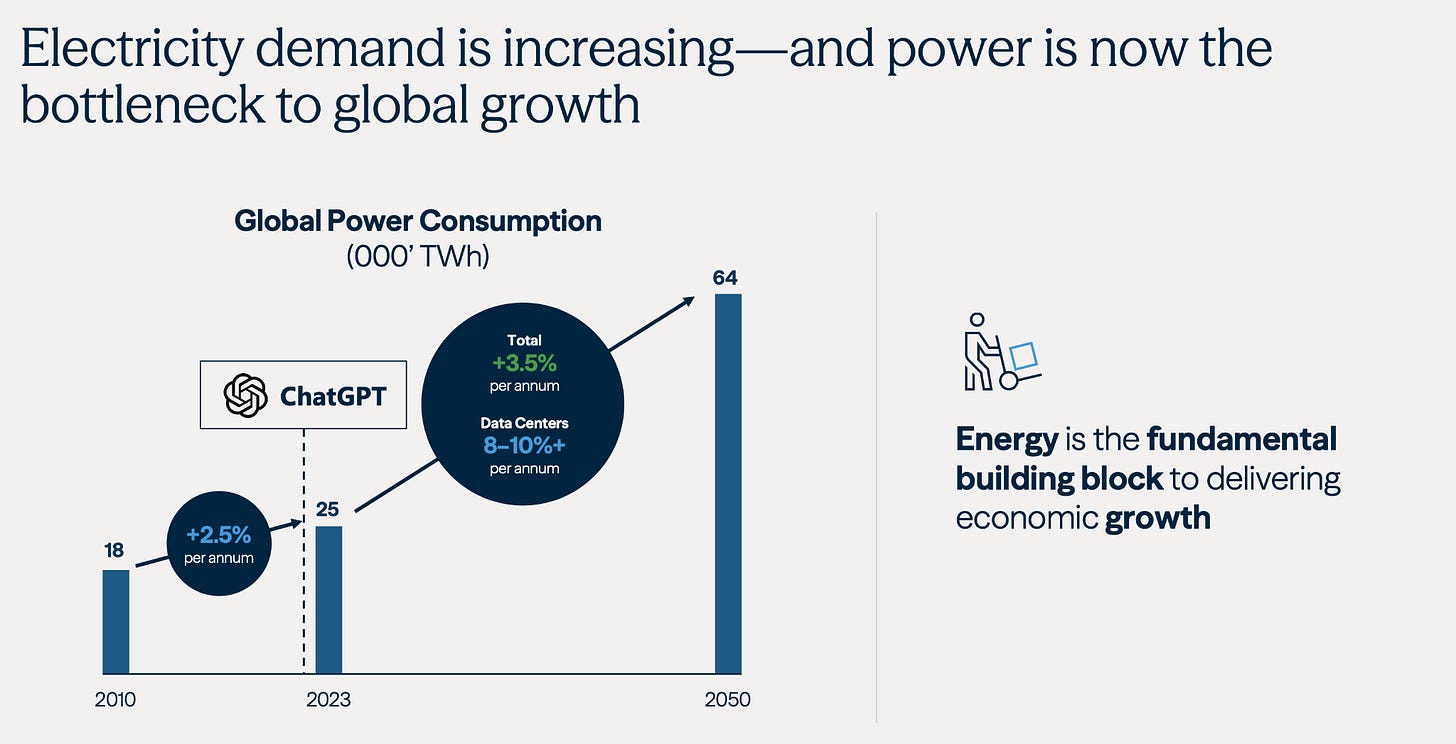

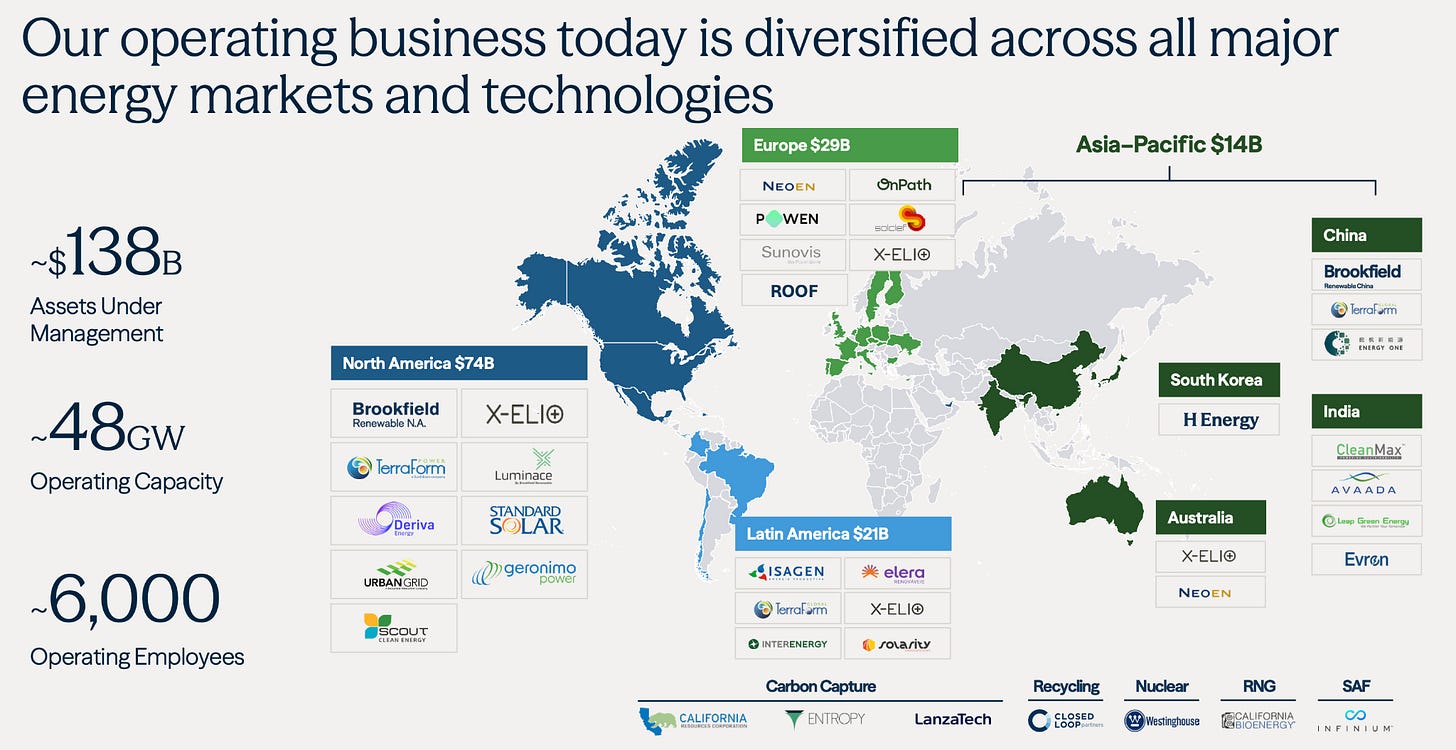

If you look at Brookfield Corporation BN 0.00%↑ and just see a complex, boring alternative asset manager, you likely aren’t looking close enough. Most investors throw Brookfield in the too-hard pile. They view it as a levered spread trade on interest rates or a fee-gathering machine, focused on Bruce Flatt’s ability to raise flagship funds in a high-rate environment. This structural opacity creates a discount that obscures the underlying asset quality. But look deeper, and you will see a transformation brewing: Brookfield is evolving from a mere investor into a critical sovereign infrastructure partner.

The catalyst is nuclear energy.

The quarterly filings, the transcripts and the strategic partnership documents reveal a thesis that the market is overlooking. When you isolate the unit economics of the nuclear portfolio, the implied valuation suggests the market is effectively pricing Brookfield’s nuclear business at a steep discount.

Here is the deep dive on the Brookfield nuclear strategy.

The $80 Billion Signal

In the Q3 2025 Letter to Shareholders, buried amidst the standard commentary on “resilient cash flows,” was a detail that signals a paradigm shift:

“...a transformational partnership with the U.S. government to deliver $80 billion of new nuclear plants in the U.S.”

This is capital deployment at a nation-state scale. Crucially, the partnership introduces a mechanism rarely seen in public markets: asymmetric sovereign alignment.

The U.S. Government receives a participation interest entitling it to 20% of cash distributions, but only after Brookfield and Cameco have recouped a $17.5 billion hurdle. By converting the U.S. Government into a partner with a vested interest in the equity upside, Brookfield has structurally mitigated a primary risk in nuclear development: political volatility.

While some will see this as a cap on upside, in nuclear, the primary risk is completion. Giving the U.S.government a 20% participation interest after locking in $17.5 billion is a cheap insurance policy for Brookfield.

The government has effectively outsourced the managerial execution risk to Brookfield (via Westinghouse) while retaining financial tail risk via the hurdle structure. Why? Because the government has regulatory authority, but lacks operational efficiency. Brookfield has the balance sheet ($178 billion in deployable capital) and the technical capability.

The Hardware Catalyst: Santee Cooper

While the $80 billion partnership is the macro signal, the execution is happening on the ground in South Carolina.

On December 8, 2025, Brookfield signed a Memorandum of Understanding to pursue the restart of the abandoned V.C. Summer nuclear project. For context: V.C. Summer was a failure. It was abandoned in 2017 after billions in cost overruns, leaving two partially built AP1000 reactors dormant.

The landscape has changed since 2017. The Vogtle 3 & 4 units in Georgia are now operational, proving the AP1000 viability. The supply chain is warm.

The details of the Santee Cooper MOU are significant:

$2.7 billion potential cash payment to Santee Cooper (contingent on final investment decision).

25% ownership stake retained by the utility.

2.2 Gigawatts of clean, baseload power brought online.

While the original licenses were terminated in 2019, the data remains valid. In nuclear regulation, the timeline killer is site characterization (seismic analysis, flood modeling, soil sampling). For V.C. Summer, this work is already codified in the NRC’s database. Brookfield isn’t starting from scratch. They are starting from a paused state, potentially shaving years off the standard timeline.

The Liability Shield

Why is South Carolina letting a private asset manager take over their grid assets? To create a financial firewall. They are using a legal structure known as ‘bankruptcy remoteness’ to ensure that if the project fails, the state isn't left holding the bag.

The state cannot afford a second failure on its balance sheet. By housing the restart within a private vehicle, Brookfield creates a liability shield. If the project spirals, the financial fallout is contained within the SPV. The state captures the power upside, but maintains plausible deniability.

The Silicon Valley Endorsement

The government de-risks the construction via the $80 billion partnership, while Big Tech underwrites the revenue.

The answer may already be signed. Let’s look at the trend. First came the 10.5 GW big tech agreement in 2024. Now, in Q3 2025, we have a 3 GW partnership with another hyperscaler specifically targeting 24/7 baseload hydro. The language is shifting from 'renewables' to 'carbon-free capacity', which is a direct invitation for nuclear.

Brookfield is not building into a void. They are essentially slotting this nuclear capacity directly into a pre-sold order book.

The Valuation Disconnect

Buying a share of BN today at ~$45 effectively provides exposure to a basket of publicly traded stocks (BAM, BEP, BIP, BBU) worth ~$28 per share (net of corporate-level debt and preferreds). This implies the market assigns a value of roughly ~$17 per share to the unlisted ecosystem, which includes $26B of real estate equity, the Wealth Solutions platform, and the proprietary carried interest rights.

This pricing offers a significant margin of safety. Even if one were to mark the unlisted commercial real estate equity entirely to zero, the current share price implies the Wealth Solutions growth engine and the carried interest rights at a distressed valuation. The market is pricing in a worst-case scenario that ignores the cash-generating reality of the non-real estate assets.

The most overlooked catalyst, however, is the $80 billion nuclear partnership. The market views this primarily as an equity story for BEP, missing the credit arbitrage that flows directly to BN.

The partnership structure creates a proprietary double dip for BN:

BN captures ~46% of the equity upside via its ownership stake in BEP.

BN’s Wealth Solutions business can capture financing economics on projects it originates or arranges.

The Risks

Why is the stock trading at ~$45 and not ~$68?

The Interest Rate Drag

Brookfield is built on leverage. While they have insulated themselves with fixed-rate, long-duration debt, the market fears that a sustained 4.5%+ 10-year-yield environment will permanently compress their IRRs. If the cost of capital stays high, the spread they earn on their massive infrastructure projects shrinks.

Office Risk

You cannot ignore the office portfolio. It acts as a heavy sentiment anchor that keeps generalist investors on the sidelines.

Duration Risk

Nuclear IRRs are exceptionally sensitive to time. In a high-cost-of-capital environment, time is the enemy.

If the V.C. Summer restart drags from a planned 4-year sprint to a 7-year slog, the math begins to break. Every month of delay compounds the carrying costs without generating revenue, effectively incinerating the project’s IRR.

The Complexity Discount is Sticky

Wall Street applies a complexity discount because the compounding happens across entities rather than within a single P&L. Brookfield’s structure is moving assets between private funds, public vehicles, and insurance floats. This makes it more opaque. Historically, conglomerates trade at a discount because investors assume where there is complexity, there is risk. There is a non-zero chance this gap never fully closes.

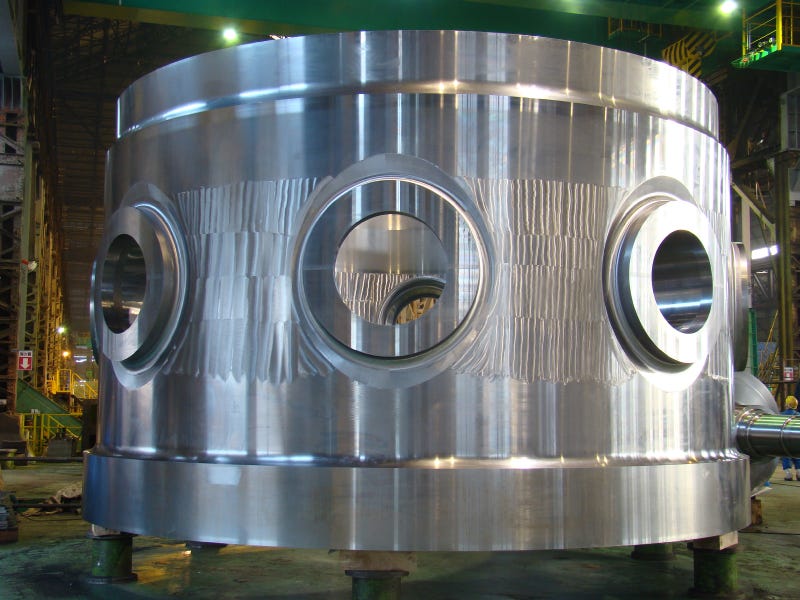

The Ultra-Heavy Forging Bottleneck

The most critical bottleneck in the global nuclear renaissance is ultra-heavy forging capacity. The main facilities capable of forging the 600-ton single-piece ingots required for the AP1000 RPV are Japan Steel Works and Doosan Enerbility.

This creates a binary risk profile. If the existing on-site reactors at V.C. Summer have suffered micro-cracking or corrosion during their 8-year dormancy, Brookfield loses its time arbitrage and joins the back of a multi-year global queue.

However, they currently possess the only available AP1000 hardware in the Western hemisphere. A September 2024 inspection by the Governor’s Nuclear Advisory Council confirmed the site is in “good condition” with significant amounts of well-preserved parts.

Execution Risk

Building nuclear power plants in the West is hard. Labor shortages, regulatory creep, and welding inspections can turn a ~5-year project into a ~10-year nightmare. Even with the lessons from Vogtle, restarting V.C. Summer is a heavy lift.

The risk here is managerial. Managing thousands of skilled tradespeople and adhering to NRC documentation standards requires perfect choreography. If costs blow out again, Brookfield’s reputation for operational excellence takes a massive hit.

The Verdict

This is a time arbitrage. In a world where data centers need power now, time is the most expensive commodity. A greenfield nuclear project is a 2032 story. V.C. Summer, being nearly half-built with major components on-site, is a 2030 story. That 2-3 year delta allows Brookfield to command premium pricing from hyperscalers who cannot afford to wait.

The market is pricing BN based on backward-looking office sentiment. It is ignoring the structural shift that has placed Brookfield at the center of the U.S. energy re-industrialization.

Do you like this $bep directly ? Gets a 4 percent dividend.

More interesting than iren..